how are rsus taxed in australia

The stock is restricted because it is subject to certain conditions. RSUs and Capital Gains Taxes.

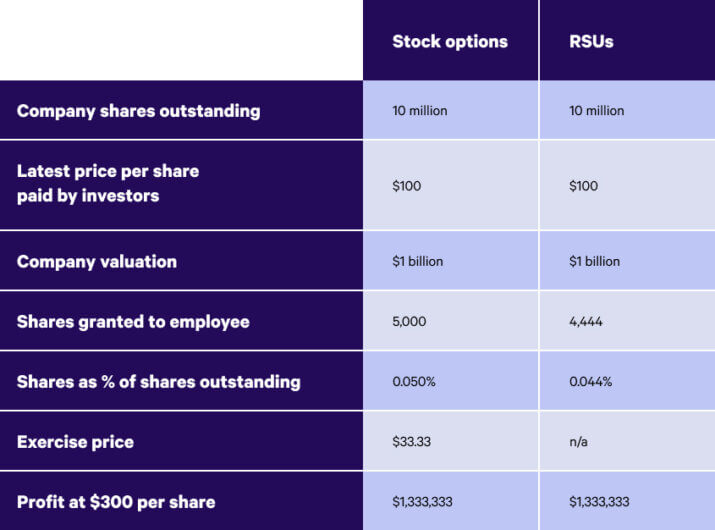

How Are Employee Stock Options And Rsus Different Sofi

After three years the RSUs become vested at an FMV of 30.

. This article provides a brief overview of the taxation of RSUs in the international context. RSU tax at vesting date is. An RSU is a grant whose worth is based on the value of the company issuing the stock.

Until a grant of RSUs vest there is no US. How Are Rsus Taxed In Australia. How Are Restricted Stock Units RSUs Taxed.

If held beyond the vesting date the RSU tax when shares. However RSUs are taxed differently. Restricted stock is a stock typically given to an executive of a company.

RSUs are a form of compensation provided by a company to their employees in the form of stocks. The Australia Tax Treaty with the United States impacts the taxation of real estate retirement pension business income and more for residents non-residents. Whilst RSUs can be easily distinguished from RSUs there are many benefits and limitations to both companies and employees which should be weighed.

RSUs are a form of compensation offered by a firm to an employee in the form of company shares. However an employee can defer the timing of Australian tax if there is a real risk of forfeiture with respect to the shares options or RSUs acquired and certain other conditions. Long-term capital gains tax on gain if held for 1 year past.

Many employees receive restricted stock units RSUs as a part of. The value of the RSUs at the time of vestment is 30000. The opportunity to buy shares in the.

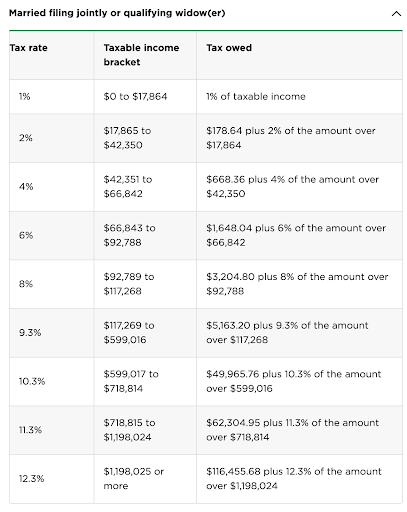

Medicare Tax - 145 then an additional 9 if over 200k if single or 250k if married. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. Social Security Tax - 62 up to 142800 then 0 after that.

The of shares vesting x price of shares Income taxed in the current year. The value at the time of granting RSUs is 25000. RSU Taxes - A tech employees guide to tax on restricted stock units.

Awards are taxed in the tax. While the US Australia. Rsus and capital gains taxes.

RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. For one a recipient cannot sell or. Difference between an rsu and stock option.

Restricted stock units are the shiny prize for countless employees in technology and other growing industries. If you sell your stock after your RSUs are converted to shares of the company youll be subject to capital gains tax as well. This is different from incentive stock.

In other words until an RSU vests it is nothing more than an unfunded promise to issue a share to the. The four taxes youll owe when you receive a paycheck or when an RSU vests include. Ordinary tax on current share value.

Also restricted stock units are subject. State Income Tax - Only applicable in certain states like. Shares in the company they work for at a discounted price.

The capital gains tax is 30 in Australia. Carol Nachbaur April 29 2022. Heres the tax summary for RSUs.

Generally an employee is taxed on the spread upon purchase of restricted stock and the spread upon vestingexercise on RSUs. If you hold the stock for. Federal Income Tax - Varies based on income.

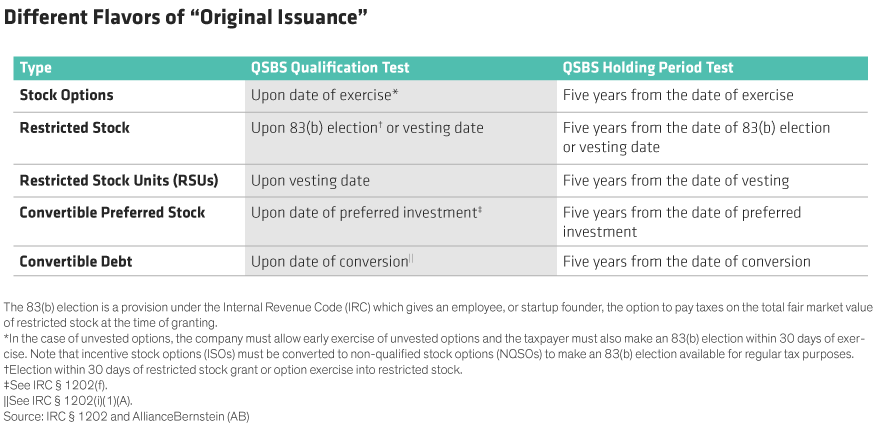

Employee share schemes ESS give employees a benefit such as. RSUs are generally subject to a vesting schedule meaning the stock does not. Those plans generally have tax consequences at the date of exercise or sale whereas restricted stock usually becomes taxable upon the completion of the vesting.

20 July 2015 500 am.

Rsus Vs Stock Options What S The Difference Wealthfront

Equity Assessment Tool Cost Tax And Compliance Info Oyster

How To Manage Us Rsus And Stock Options Awards When Living Overseas Money Matters For Globetrotters

Pdf Does Corporate Tax Avoidance Promote Managerial Empire Building

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Understanding Rsus And Options

Rsus Vs Options What S The Difference How To Switch Carta

How To Avoid Taxes On Rsus Equity Ftw

Global Equity Tax Equalization And Compensation Survey Deloitte Us

Smart Tax Strategies Return Tips And Mistakes To Avoid With Equity Compensation

Form Of Rsu Award Agreement First Solar Business Contracts Justia

Gms Flash Alert Tax Kpmg Global

When It Comes To Qsbs Timing Is Everything Context Ab

What Are Restricted Stock Units Rsus Lawpath

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsus A Tech Employee S Guide To Restricted Stock Units

How Restricted Stock Units Work Employee Benefits Explained What Are Rsus Youtube

Restricted Stock Units Rsus Facts

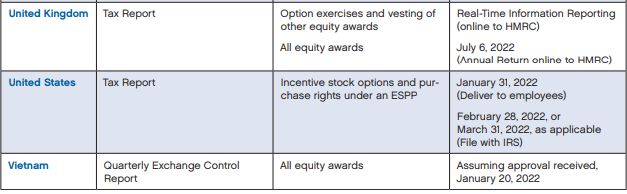

Employee Stock Plans International Reporting Requirements Employee Rights Labour Relations Worldwide